Effective Credit Union Marketing:

Our Top 5 Tips

When it comes to credit union marketing, we’ve seen it all. With years of experience working exclusively with credit unions, we’ve had the privilege to adapt and grow alongside the industry. We’ve witnessed the delicate balance between maintaining consistent branding and embracing innovation. Credit unions have a fierce attachment to their roots, and it’s crucial to keep that connection while shaking things up just enough to stay relevant.

At the heart of credit union marketing is the member relationship. Members come first, and we’ve mastered the art of strengthening these bonds through effective, resonant marketing strategies. We often hear about the importance of focusing on what makes credit unions unique—their “bread and butter.” For us, credit union marketing is our bread and butter.

Here are the top 5 tips we’ve found to be crucial for navigating this niche space and achieving fruitful outcomes:

Tip 1: Consistency is Key

Consistency is imperative to any successful company, but for credit unions, consistency equals reinforcement of trust. It gives members peace of mind and confidence in your credit union as a reliable companion in their life journey. Credit union marketing thrives on its members, so consider what differentiates a credit union from a regular bank. Members have chosen you to handle one of the most vital aspects of their daily lives—managing their finances.

Our work has shown that maintaining cohesive branding—through consistent tone, voice, and design—combined with regular marketing and member engagement, fosters a reassuring sense of consistency. Inconsistency can hinder brand awareness, as even regular marketing efforts are undermined when key characteristics are misaligned, negatively impacting members’ association with your credit union. This aligns with The Consistency Principle, which emphasizes people’s strong psychological need for consistency in their attitudes, beliefs, and actions. This principle suggests that when your marketing strategy consistently reflects the same values, designs, and messages, it creates a sense of familiarity and trust. Members are more likely to follow through with decisions that align with their prior beliefs and actions, highlighting their natural tendency to seek certainty and coherence in everyday life.

Tip 2: Building a Strong Connection

Integrating a strong connection into your marketing strategy requires seamless alignment with consistency and emotional engagement. At Full Tank Creative, we’ve seen how strategies focused on delivering consistent, connecting content can significantly enhance emotional connections and member engagement.

The Power of Storytelling in Credit Union Marketing

Storytelling in credit union marketing goes beyond presenting facts and features. It involves crafting narratives that establish emotional connections and effectively communicate the value and purpose of your brand, product, or service. Our insights from “The Power of Storytelling for Credit Unions” webinar underscore this approach.

Contrary to focusing solely on statistics or features, storytelling delves into human experiences. It resonates with audiences by addressing their struggles and aspirations, demonstrating empathy, and offering solutions. By creating compelling visuals and narratives that capture the emotional journey—its highs and lows—we show members that we understand their needs and are committed to supporting them.

Insights from Research: The Impact of Storytelling in Credit Union Marketing

According to the scholarly journal Communication Design and Branding, storytelling shares fundamental traits with marketing practices (Marques et al., 2023). Storytelling in marketing not only fosters brand identification and awareness but also significantly enhances customer engagement. Moreover, it provides audiences with avenues for self-expression, a sense of belonging, and a comprehensive understanding of the brand.

Understanding your audience is key. Constant Contact’s article, 2023 Email Marketing Statistics: Facts, Trends & Figures reported in 2023 that 71% of consumers prefer to purchase products from companies that relate and share their values. Storytelling content serves as a powerful indicator of how well your messaging will resonate with members. Tailoring your narratives to reflect and address members’ experiences enhances engagement by demonstrating a deep understanding of their journey and needs.

The 2023 Credit Union Digital Experience Report, conducted annually by Finalytics.ai and focusing on the largest Credit Unions in America to analyze digital experiences in the industry, further emphasizes the importance of aligning digital experiences with member expectations. This comprehensive analysis of major credit unions in America reveals opportunities for credit unions to demonstrate empathy and understanding towards members’ personal journeys.

Full Tank Creative’s Approach to Storytelling

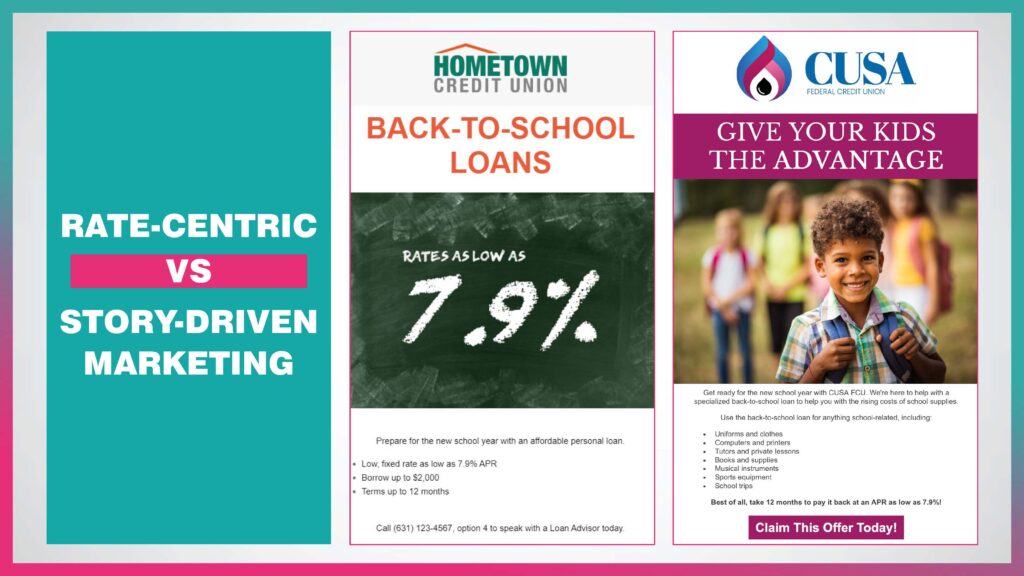

Storytelling isn’t just about standing out in a crowded market; it’s about making a lasting impact that builds loyalty and transcends mere transactions. Consider the difference between focusing solely on rates and crafting narratives that resonate:

One approach touches hearts by tapping into universal desires, like parents’ aspirations for their children’s future, rather than just offering seasonal discounts. Highlighting our success, campaigns like these have achieved exceptional results, with CTO rates reaching up to 40%—a standout achievement in the CU industry, where the average hovers around 28% (Constant Contact, 2023).

Benefits of Emotional Connection with Members

By humanizing your credit union, you create a bond beyond financial transactions. This approach not only builds loyalty but also keeps your credit union top of mind. Strong relationships lead to member advocacy, driven by genuine emotional connections.

Real-Life Impact: Case Study with Saint Vincent’s FCU

We’ve witnessed firsthand how storytelling can drive real results. Through our collaboration, Saint Vincent’s FCU achieved significant success, closing $255k in loans through engaging, story-driven digital content.

Tip 3: Calls-to-Action

Compelling Calls-to-Action (CTAs) are like the punctuation marks of your marketing campaigns, prompting members to take specific actions such as “click here” or “fill out our form.” While CTAs can appear as buttons, text, or other elements, a simple button won’t necessarily win over a member. Engaging and clear messaging is key to enticing them to “learn more.”

Think of CTAs as the key to your campaigns, much like a map’s legend that helps travelers understand symbols and directions. A well-crafted CTA guides your members through their journey with your credit union, providing clear steps to move from interest to action seamlessly.

When crafting campaigns, it’s easy to overlook how CTAs appear to someone seeing them for the first time. Members view content with fresh eyes, so it’s crucial to make your CTAs visually appealing and clearly defined. Clear and consistent CTAs help direct members to preferred destinations like contact forms and landing pages. Ensure that your landing page content matches your CTAs to reinforce consistency and build confidence, guiding members smoothly through their journey.

To make things easier, we’ve provided a free downloadable PDF version of the Three “C’s” of Credit Union Marketing PDF to keep these top tips handy.

Tip 4: Leverage Digital Marketing

The digital space can feel like a big leap for businesses that have thrived on personal relationships and face-to-face interactions. However, just because you aren’t always face-to-face doesn’t mean you have to lose that personal touch, which is a hallmark of the email credit union space. From our experience with credit unions, there can sometimes be a struggle between trying something new and not trying to reinvent the wheel. It’s a balancing act that many have managed to perform with great success.

While we value the traditions and core aspects that have built your credit unions, there are now more ways than ever to reach members. Think of it as reinforcement: there will always be individuals who love your personal face-to-face interactions, but new generations may need a different approach to understand your values and offerings.

The 2023 Credit Union Digital Experience Report by Finalytics.ai highlights that “an average of 76% of all member interactions happen online.” According to their findings, “by 2024, the digital channel will be the source of most product applications for credit unions.” This increased level of digital interaction underscores the importance of bringing your digital presence up to date to meet members where they are.

“An average of 76% of all member interactions happen online.”

2023 Credit Union Digital Experience Report, Finalytics.ai

Creating a Strong Digital Presence

Our insights from the 2023 Credit Union Digital Experience Report emphasize the necessity of a robust digital presence. With a primary focus on maintaining the heart and soul of traditional credit union marketing, integrating a digital presence is vital for reaching younger generations. This shift bridges the gap between familiar face-to-face interactions and modern digital engagement, ensuring that your values and offerings resonate with a broader audience (Finalytics.ai, 2023).

To effectively connect with members online, incorporate the elements of your traditional marketing approach into the digital realm. This can involve leveraging your online presence through engaging social media content, targeted email campaigns, and interactive website features. By doing so, you maintain the authenticity and personal touch that have defined your credit union while embracing the digital tools that resonate with today’s members.

Social Media for Digital Awareness

Social media platforms like Facebook and Instagram offer unparalleled opportunities to connect with members, especially those who prefer to interact digitally. These platforms enable you to showcase your credit union’s personality, share stories of member success, and provide real-time updates on promotions and events.

One approach we’ve found effective is creating content that aligns with your members’ values and interests. For instance, sharing stories of community involvement, financial education tips, and member testimonials can resonate deeply with your audience. By crafting authentic and relatable content, you strengthen the emotional connection with your members.

Email Marketing for Digital Engagement

Despite the rapid rise of social media, 2023 Email Marketing Statistics: Facts, Trends & Figures confirms that email remains the preferred channel for updates, with a striking 55% of consumers citing it as the top way to stay informed about their favorite businesses and nonprofits. This enduring preference marks the impact and effectiveness of email marketing.

Email marketing not only offers a preferred method of engagement but also delivers tangible ROI. According to Statista, average companies generate $36 in revenue for every dollar spent on email marketing, with some achieving returns as high as $45 per dollar invested—an exceptional ROI. This success is attributed to email marketing’s direct communication approach, ensuring that messages reach members directly in their inbox without relying on social media algorithms (Constant Contact, 2023).

Effective email campaigns that convert seamlessly integrate the previously mentioned tips, consistency, storytelling elements and clear calls-to-actions. Timing and relevance are equally vital, ensuring that emails resonate with members at the right moment with content that matters to them.

Another high-yield engagement strategy is to include incentives. While the credit union industry may differ from e-commerce in its calls-to-action, the underlying principles remain the same. For instance, email campaigns offering discounts see an astounding 67% conversion rate (Constant Contact, 2023). In the credit union space, leveraging seasonal sales tactics—such as promotions on loans, credit card APRs, and savings account APYs—further enhances member participation and satisfaction. Additionally, providing regular updates about your credit union’s operations keeps members informed about important changes and news, fostering both high engagement and trust.

55%

of consumers prefer email for updates from businesses

$36

of revenue generated for every $1 spent on email marketing

67%

conversion rate for email campaigns that offer discounts

Tip 5: Measure and Optimize

All your effort and dedication in marketing culminates in the exciting moment when you see its impact. Don’t be afraid to crunch the numbers—when approached with the right mindset, marketing analytics become invaluable tools. They not only highlight performance trends but also reveal the effectiveness of your marketing and how your audience is responding. They show what’s working, what’s resonating, and where adjustments are needed.

Setting specific goals and benchmarks for your key performance indicators (KPIs) is essential when launching campaigns. These benchmarks provide a clear standard to measure progress and gauge whether your marketing efforts are resonating with your audience and achieving tangible results. Effective benchmarking involves leveraging historical data from past campaigns and industry metrics to understand how your credit union compares to others.

Tracking KPIs such as engagement rates, click-to-open rates, conversion rates, and member acquisition costs is crucial for gaining insights into member behavior and campaign effectiveness. For instance, if your engagement rate is below industry benchmarks, it may indicate that your content isn’t resonating with your audience, prompting a need for strategy adjustment.

Consistently monitoring these metrics enables data-driven decisions to optimize marketing strategies. This includes refining content, testing new approaches, and ensuring alignment with your credit union’s objectives to better meet member needs. Analyzing KPIs against benchmarks provides critical insights into the return on investment (ROI) of your marketing efforts, demonstrating the value of your campaigns and guiding effective resource allocation.

According to Nickels Blog Post Credit Union Digital Marketing, campaign analytics offer tangible proof of your efforts, allowing you to customize and tweak your marketing approaches (Erin Petro, 2024). Different KPIs can showcase areas needing improvement, eliminating guesswork and providing clear direction for your marketing strategy.

By measuring and optimizing your campaigns, you ensure that every effort is accounted for and that your credit union continues to grow and engage effectively with its members.

Ready to Transform Your Marketing?

With these tips in your arsenal, you’re well on your way to enhancing your credit union’s marketing efforts. Remember, the journey of marketing is filled with learning and adaptation, and each step will bring you closer to your goals.

If you’re interested in taking your credit union marketing to the next level, we’re here to help. Visit here to learn more about how we can support your marketing needs.